International

Stocks stumble to end ‘miserable’ 2022

| By AFP | Roland Jackson |

Stock markets wrapped up their worst performances in years on Friday before heading into 2023 under recession fears following Russia’s invasion of Ukraine, high inflation and rising interest rates.

Both US and European indices closed their final sessions of the year in the red.

For the year, Frankfurt was down more than 12 percent and Paris lost 9.5 percent for their worst performances since 2018. London, however, was up 0.9 percent in 2022 as the energy sector was buoyed by soaring energy prices.

Wall Street saw its worst annual drop since 2008, with the S&P 500 index down around 20 percent and the tech-heavy Nasdaq losing about 30 percent for the year.

Equities were slammed as the US Federal Reserve, European Central Bank and Bank of England aggressively lifted interest rates in a bid to tackle rampant consumer price rises. The move carries the risk of sparking recession as higher borrowing costs slow economic activity.

US tech companies were hit particularly hard as they are usually boosted by lower interest rates.

The MCSI World Equity Index has lost almost a fifth in its worst annual performance since 2008, when markets were ravaged by the global financial crisis.

Asia-Pacific markets finished their last sessions mostly in the green on Friday.

But for the year, Hong Kong tanked 15.5 percent and Shanghai dived 15.1 percent in the biggest annual slumps since 2011 and 2018, respectively.

Covid spiked once more in China in December, after Beijing relaxed its strict curbs in the face of rare public outcry. The surge has also prompted worries about the impact on stretched global supply chains.

Tokyo plunged 9.4 percent in the first annual fall since 2018 but the Bank of Japan maintained its ultra-easy monetary policy, in contrast with other central banks, to help its fragile economy.

‘Pitiful end to miserable year’

“It’s shaping up to be a pitiful end to a miserable year in stock markets,” OANDA trading platform analyst Craig Erlam told AFP.

He said 2022 had “brought an end to an era” of low interest rates that fueled tech and crypto booms.

“That’s been replaced with soaring inflation and interest rates, immense economic uncertainty and the reshaping of energy markets in the aftermath of the Russian invasion of Ukraine,” Erlam added.

In commodities, oil prices rallied in 2022 with Brent gaining about 10 percent and the West Texas Intermediate adding around seven percent.

However, they remain significantly below peaks struck in March on supply woes after key producer Russia invaded its neighbor, sending natural gas prices also spiking.

Britain and other major economies now face the likely prospect of grim recessions next year, as consumers and businesses battle rampant inflation and rising rates after years of ultra-low borrowing costs.

“The most important take of the year is: the era of easy money ended, and ended for good,” noted SwissQuote analyst Ipek Ozkardeskaya.

“And given that there is still plenty of cheap central bank liquidity waiting to be pulled back, the situation may not get better before it gets worse,” she said.

“Recession, inflation, stagflation will likely dominate headlines next year.”

London was down 0.8 percent and Frankfurt shed 1.1 percent in half-day sessions ahead of the New Year holiday. Paris closed 1.5 percent lower.

On Wall Street, the Dow ended 0.2 percent lower while the tech-heavy Nasdaq shed 0.1 percent.

“It would appear that people have checked out for the year — and have settled back into holiday mode for New Year celebrations,” Erlam said.

Key figures around 2145 GMT

New York – Dow: DOWN 0.2 percent at 33,147.25 (close)

New York – S&P 500: DOWN 0.3 percent at 3,839.50 (close)

New York – Nasdaq: DOWN 0.1 percent at 10,466.48 (close)

London – FTSE 100: DOWN 0.8 percent at 7,451.74 (close)

Frankfurt – DAX: DOWN 1.1 percent at 13,923.59 (close)

Paris – CAC 40: DOWN 1.5 percent at 6,473.76 (close)

EURO STOXX 50: DOWN 1.5 percent at 3,793.62 (close)

Tokyo – Nikkei 225: FLAT at 26,094.50 (close)

Hong Kong – Hang Seng Index: UP 0.2 percent at 19,781.41 (close)

Shanghai – Composite: UP 0.5 percent at 3,089.26 (close)

Euro/dollar: UP at $1.0704 from $1.0667 on Thursday

Pound/dollar: UP at $1.2094 from $1.2062

Euro/pound: UP at 88.47 pence from 88.40 pence

Dollar/yen: DOWN at 131.11 yen from 132.96 yen

West Texas Intermediate: UP 2.4 percent at $80.26 per barrel

Brent North Sea crude: UP 2.9 percent at $85.91

International

U.S. Senate Rejects Budget, Bringing Government Closer to Shutdown Amid DHS Dispute

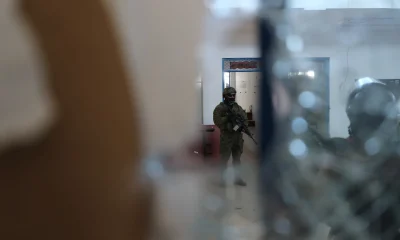

The U.S. Senate voted on Thursday against a budget proposal in a move aimed at pressuring changes at the Department of Homeland Security (DHS), following the killing of two civilians during a deployment of immigration agents in Minneapolis.

All Senate Democrats and seven Republican lawmakers voted against the bill, which requires 60 votes to advance, pushing the country closer to a partial government shutdown that would cut funding for several agencies, including the Pentagon and the Department of Health.

The rejection came as Senate leaders and the White House continue negotiations on a separate funding package for DHS that would allow reforms to the agency. Proposed measures include banning Immigration and Customs Enforcement (ICE) agents from wearing face coverings and requiring them to use body-worn cameras during operations.

The vote took place just hours after President Donald Trump said he was “close” to reaching an agreement with Democrats and did not believe the federal government would face another shutdown, following last year’s record stoppage.

“I don’t think the Democrats want a shutdown either, so we’ll work in a bipartisan way to avoid it. Hopefully, there will be no government shutdown. We’re working on that right now,” Trump said during a Cabinet meeting at the White House.

International

Trump Says Putin Agreed to One-Week Halt in Attacks on Ukraine Amid Extreme Cold

U.S. President Donald Trump said on Thursday that he secured a commitment from Russian President Vladimir Putinto halt attacks against Ukraine for one week, citing extreme weather conditions affecting the region.

“Because of the extreme cold (…) I personally asked Putin not to attack Kyiv or other cities and towns for a week. And he agreed. He was very pleasant,” Trump said during a Cabinet meeting broadcast by the White House.

Trump acknowledged that several advisers had questioned the decision to make the call.

“A lot of people told me not to waste the call because they wouldn’t agree. And he accepted. And we’re very happy they did, because they don’t need missiles hitting their towns and cities,” the president said.

According to Trump, Ukrainian authorities reacted with surprise to the announcement but welcomed the possibility of a temporary ceasefire.

“It’s extraordinarily cold, record cold (…) They say they’ve never experienced cold like this,” he added.

Ukrainian President Volodymyr Zelensky later commented on the announcement, expressing hope that the agreement would be honored.

International

Storm Kristin Kills Five in Portugal, Leaves Nearly 500,000 Without Power

Storm Kristin, which battered Portugal with heavy rain and strong winds early Wednesday, has left at least five people dead, while nearly half a million residents remained without electricity as of Thursday, according to updated figures from authorities.

The revised death toll was confirmed to AFP by a spokesperson for the National Emergency and Civil Protection Authority (ANPEC). On Wednesday, the agency had reported four fatalities.

Meanwhile, E-Redes, the country’s electricity distribution network operator, said that around 450,000 customers were still without power, particularly in central Portugal.

Emergency services responded to approximately 1,500 incidents between midnight and 8:00 a.m. local time on Wednesday, as the storm caused widespread disruptions.

The Portuguese government described Kristin as an “extreme weather event” that inflicted significant damage across several regions of the country. At the height of the storm, as many as 850,000 households and institutions lost electricity during the early hours of Wednesday.

Several municipalities ordered the closure of schools, many of which remained shut on Thursday due to ongoing adverse conditions.

Ricardo Costa, regional deputy commander of the Leiria Fire Brigade, said residents continue to seek assistance as rainfall persists.

“Even though the rain is not extremely intense, it is causing extensive damage to homes,” he noted.

In Figueira da Foz, a coastal city in central Portugal, strong winds toppled a giant Ferris wheel, underscoring the severity of the storm.

-

Central America5 days ago

Central America5 days agoGuatemala Police Arrest Prison Guard Caught in the Act of Extortion

-

Central America5 days ago

Central America5 days agoHonduras swears in conservative president Asfura after disputed election

-

Central America5 days ago

Central America5 days agoBukele leads public trust rankings as UCA survey highlights gains in security

-

International4 days ago

International4 days agoFootball Fan Killed in Clashes After Colombian League Match

-

Central America4 days ago

Central America4 days agoGuatemala President Says Starlink Terminal Found Inside Prison

-

International5 days ago

International5 days agoDoomsday clock moves to 85 seconds before midnight amid rising global risks

-

International5 days ago

International5 days agoWinter Storm Fern Leaves 30 Dead and Over One Million Without Power Across the U.S.

-

International3 days ago

International3 days agoU.S. Senate Rejects Budget, Bringing Government Closer to Shutdown Amid DHS Dispute

-

Sin categoría5 days ago

Sin categoría5 days agoEight Killed in Series of Armed Attacks in Ecuador’s Manabí Province

-

International5 days ago

International5 days agoSpain approves plan to regularize up to 500,000 migrants in Historic Shift

-

International4 days ago

International4 days agoMissing Spanish Sailor Rescued After 11 Days Adrift in Mediterranean

-

International4 days ago

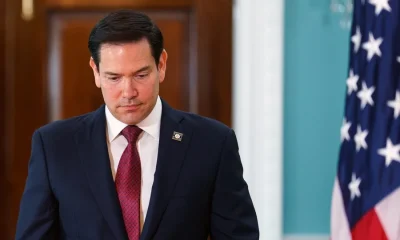

International4 days agoRubio Says U.S. Could Participate in Follow-Up Russia-Ukraine Talks

-

Sin categoría5 days ago

Sin categoría5 days agoEl Salvador Launches Fourth Year of Ocean Mission to Protect Marine Ecosystems

-

Central America2 days ago

Central America2 days agoPanama Supreme Court Strikes Down Panama Ports Concession as Unconstitutional

-

International3 days ago

International3 days agoStorm Kristin Kills Five in Portugal, Leaves Nearly 500,000 Without Power

-

Central America2 days ago

Central America2 days agoU.S. and Guatemala Sign Trade Deal Granting Zero Tariffs to Most Exports

-

International3 days ago

International3 days agoTrump Says Putin Agreed to One-Week Halt in Attacks on Ukraine Amid Extreme Cold

-

International3 days ago

International3 days agoMan Arrested After Vehicle Crashes Into Jewish Institution in Brooklyn